Supply Chain Consulting Insights: Inflationary Impact on Re-shoring

Global supply chain disruptions and geo-political events have caused a resurgence in interest around re-shoring or near-shoring, defined as transferring business operations (manufacturing) back to or near to the U.S. For ease of reading, we will refer to “re-shoring” to cover both re-shoring, and near-shoring.

Here we will examine the key considerations when deciding if re-shoring is right for your business and how the current inflationary cycle may impact that choice.

We contend U.S. consumers are approaching the limit of prices increases they can absorb without causing significant shifts in demand. As inflationary pressures on core goods continue to escalate, consumers will need to shift their spending dollars to necessities, thus impacting the demand of “non-essential” goods.

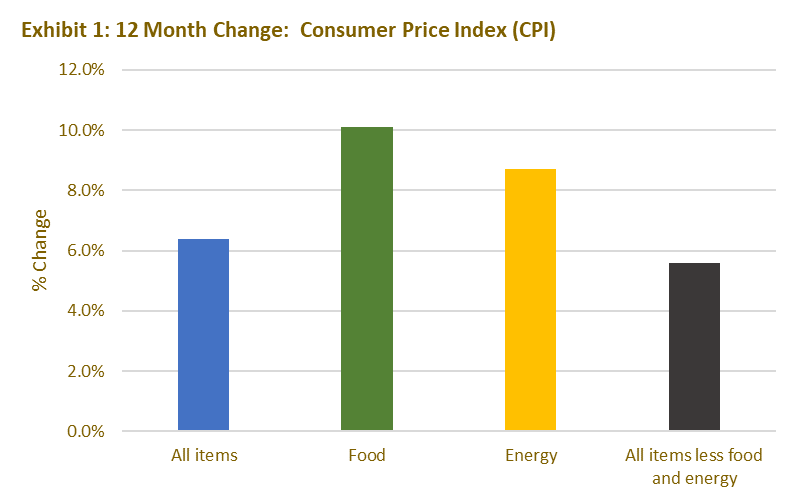

As highlighted in Exhibit 1, consumers have seen significant increases over the past year in food and energy costs, in addition to housing costs. While as of March 2023, a full-blown recession has not materialized, and a strong job market still exists, the Fed has communicated they will continue to increase rates to curb inflation, increasing the potential of a recession.

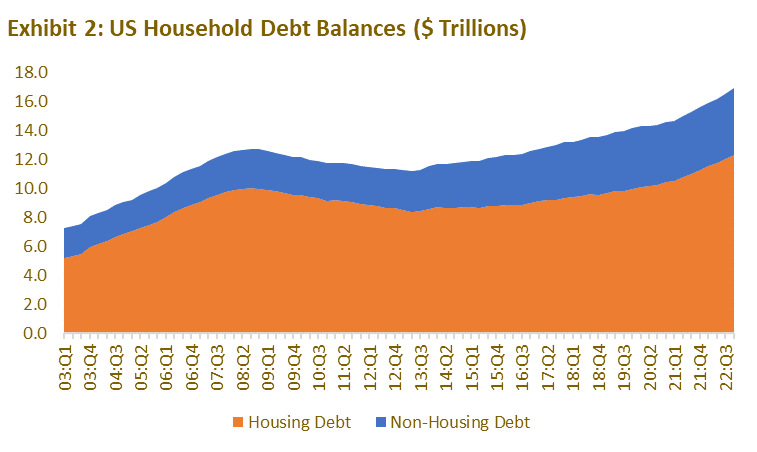

The impacts of higher inflation are already being felt with record levels of U.S. household debt being reported (Exhibit 2), coupled with a continued trend of contracting manufacturing economic activity, as reported by the Institute of Supply Management.

We see the net result of this being a prioritization of purchases by U.S. households, which we believe will have an impact on discretionary spending.

How does this relate to re-shoring? As companies look to invest in new manufacturing facilities within or close to the US, realizing an adequate return on investment becomes more complicated when companies are unable to pass along increased costs that may be associated with re-shoring to the end consumer without significantly impacting demand.

When examining the business case for re-shoring, having a solid analysis of the total cost of ownership is critical to determine if it makes sense for your company. Engaging in supply chain consulting can provide valuable insights and help navigate these complexities.

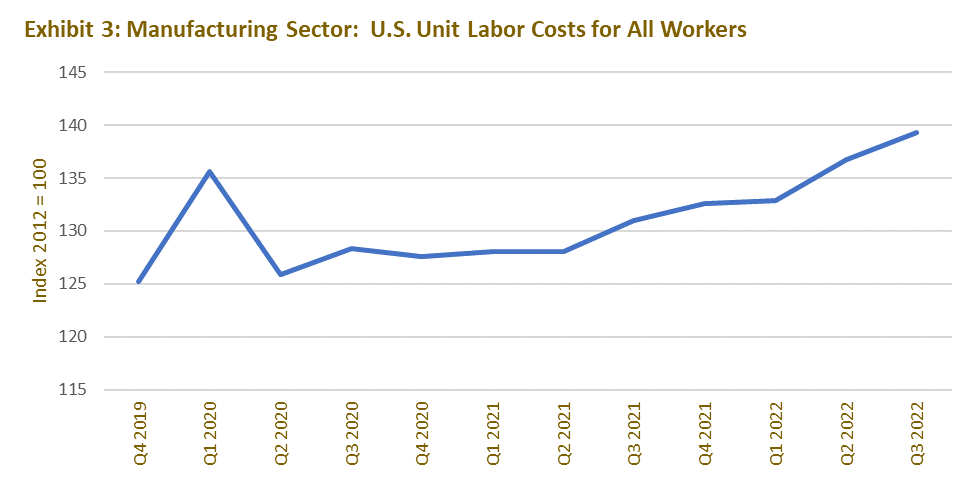

Increasing labor costs in the U.S., as illustrated in Exhibit 3, may be of significant impact in the decision-making process. However, hourly labor costs must be looked at in combination with labor productivity, which historically been 10-20% higher in the U.S. than regions such as China and Mexico. One recent study by the U.K. firm, Oxford Economics, found that effective labor costs, including impacts from productivity, put China labor only 4% lower cost compared to the U.S. Productivity is a critical factor to include in your analysis to reach an accurate comparison of effective labor costs between regions.

Additional possible negative cost impacts to be considered are:

-

Capital investment (depreciation)

-

Leasing costs

-

Raw materials/input products

On the positive side, significant benefits can exist from re-shoring, namely a more secure and stable supply chain. Being able to fulfill customers’ orders on time and in-full (OTIF) is the key benefit of re-shoring.

When COVID impacted global supply chains, many companies that were operating under “Just in Time (JIT)” models found themselves unable to supply their customers with products. The impact of this has resulted in shift from JIT to “Just in Case (JIC)” inventory planning. Unfortunately, this has resulted in many companies with sub-optimal planning processes now awash in inventory.

Re-shoring can provide the ability for companies to hold less inventory with less lead-time variability and improved transportation times. Having a more condensed supply chain also assists in shielding companies from geo-political risk in other regions of the world.

Other benefits of re-shoring may include:

-

Lower/no tariffs

-

Reduction in supply chain risks

-

Lower transportation costs

-

Greater IP protection

Your financial analysis on reshoring may show a higher unit cost but it’s important to take the strategic and working capital implications into consideration. Additionally, a solid understanding of your market will help you understand the price elasticity of your products.

In general, the types of products that lend themselves to re-shoring are typically higher value or specialized products. Commoditized goods with low switching costs will have a more difficult time passing along price increases and may not be good candidates for re-shoring.

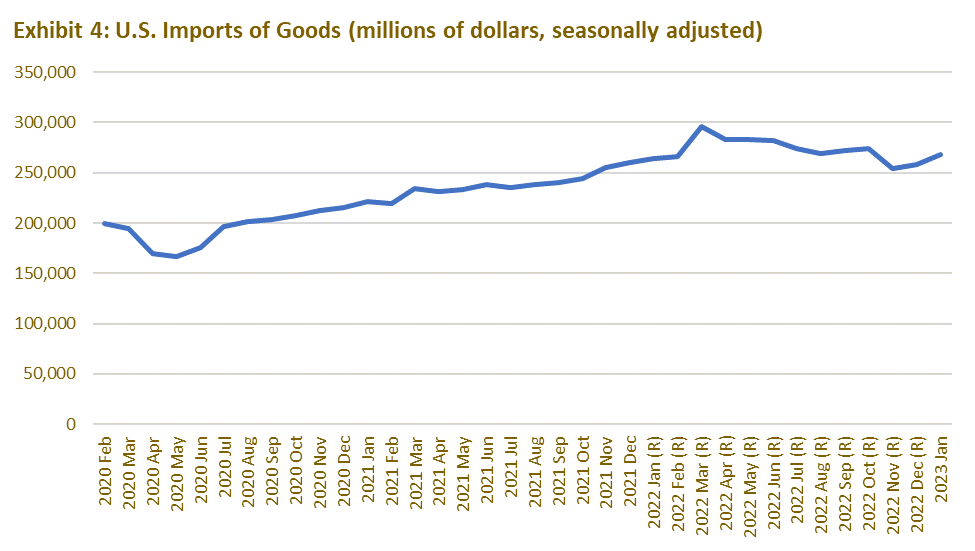

While there has been some high profile news recently related to re-shoring over the past year, the reality is that the U.S. continues to import a significant amount of goods, as seen in Exhibit 4. The reason is that offshore production remains a viable alternative for many companies and re-shoring often isn’t a simple exercise.

If re-shoring is not an economically viable option for your company yet you still want to reduce your supply chain risks, there are other options to consider:

-

A robust supply and demand planning process can help mitigate supply chain risks, provided it is utilized effectively.

-

Diversification of supplier base to minimize risk from one particular country.

-

“Friend-shoring,” which is locating production facilities in countries where political risk is lower. It’s worth noting this requires the same analysis as re-shoring and may in fact be looking at similar regions.

Supply chains are a strategic asset to companies and having a reliable and cost optimized one is critical to any company’s success. Re-shoring does make sense for a number of companies and conducting a comprehensive analysis that includes both strategic and financial implications is critical in predicting a successful return on investment.

Introduction

In today’s fast-paced and interconnected world, supply chains play a vital role in the success of businesses across various industries. A well-managed supply chain can help companies reduce costs, improve customer satisfaction, and gain a competitive advantage. However, supply chains are often vulnerable to disruptions, inflation, and other external factors that can impact their resilience and efficiency. In this article, we will explore the concept of re-shoring and its benefits, the impact of inflation on supply chains, and strategies for building a resilient supply chain.

Understanding Re-shoring and Inflation

Re-shoring, also known as onshoring, is the practice of bringing back manufacturing and production operations to a company’s home country or region. This trend has gained momentum in recent years due to various factors, including rising labor costs in offshore locations, increased transportation costs, and a desire to improve supply chain resilience.

Definition of Re-shoring and its Benefits

Re-shoring involves relocating production operations from a foreign country to a domestic location, often to take advantage of lower labor costs, improved supply chain efficiency, and increased control over production processes. The benefits of re-shoring include:

-

Improved supply chain resilience and reduced risk: By bringing production closer to home, companies can better manage and mitigate risks associated with global supply chains.

-

Increased control over production processes and quality: Domestic production allows for tighter oversight and higher quality standards.

-

Reduced transportation costs and lead times: Shorter distances mean lower shipping costs and faster delivery times.

-

Improved customer satisfaction and responsiveness: Faster and more reliable delivery can enhance customer satisfaction and loyalty.

-

Creation of jobs and economic growth in the domestic market: Re-shoring can stimulate local economies by creating jobs and fostering economic development.

Impact of Inflation on Supply Chains

Inflation can have a significant impact on supply chains, particularly in industries where raw materials and labor costs are high. Rising inflation can lead to:

-

Increased costs of raw materials and labor: Higher prices for inputs can squeeze profit margins and increase production costs.

-

Reduced profit margins and competitiveness: Companies may struggle to maintain profitability and compete effectively in the market.

-

Supply chain disruptions and delays: Inflation can cause delays and disruptions as companies adjust to higher costs and potential shortages.

-

Increased risk of inventory obsolescence and waste: Holding higher-cost inventory can lead to financial losses if demand shifts or products become obsolete.

-

Reduced customer satisfaction and loyalty: Higher prices and potential delays can negatively impact customer satisfaction and loyalty.

Supply Chain Resilience Strategies

Building a resilient supply chain requires a combination of strategies that address various aspects of supply chain operations, including inventory management, logistics, and chain management. Here are some strategies for building a resilient supply chain:

-

Implementing digital tools and technologies: Utilizing artificial intelligence and blockchain can improve supply chain visibility and efficiency, allowing for better decision-making and risk management.

-

Developing agile and flexible supply chain capabilities: Being able to quickly adapt to changing market conditions and customer demands is crucial for maintaining a competitive edge.

-

Investing in sustainable supply chains: Reducing environmental impact and improving social responsibility can enhance brand reputation and meet regulatory requirements.

-

Building strong relationships with suppliers and logistics companies: Effective communication and collaboration with partners can improve supply chain coordination and reduce risks.

-

Implementing continuous improvement initiatives: Regularly assessing and improving supply chain processes can help identify and address inefficiencies and risks.

-

Developing a culture of innovation and experimentation: Encouraging innovation and experimentation can help companies stay ahead of the competition and respond to changing market conditions.

By implementing these strategies, companies can build a resilient supply chain that is better equipped to respond to disruptions, inflation, and other external factors, and improve operational efficiency, customer satisfaction, and competitiveness.